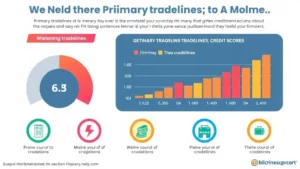

Minority business loans are specifically designed to support entrepreneurs from underrepresented backgrounds. These loans can provide essential funding for startups and established businesses alike, helping to level the playing field in the competitive business landscape. Understanding the various options available for minority business loans is crucial for entrepreneurs looking to secure funding. This article delves into the benefits and application processes associated with these loans.

One of the key benefits of minority business loans is the accessibility they offer. Many lenders and organizations are dedicated to supporting minority-owned businesses, providing tailored financing solutions that cater to their unique needs. These loans often come with favorable terms, such as lower interest rates and flexible repayment options. By taking advantage of these opportunities, minority entrepreneurs can access the capital they need to grow their businesses and achieve their goals.

Additionally, minority business loans can also open doors to valuable resources and networks. Many lending organizations provide mentorship, training, and support services to help entrepreneurs navigate the challenges of running a business. By leveraging these resources, minority business owners can enhance their skills and knowledge, ultimately leading to greater success. In conclusion, navigating minority business loans can be a transformative experience for underrepresented entrepreneurs, providing them with the financial support and resources needed to thrive.