The Small Business Administration (SBA) offers a variety of loan programs designed to assist small businesses in obtaining the funding they need. These loans are backed by the government, which reduces the risk for lenders and makes it easier for businesses to secure financing. Understanding the different types of SBA loans available can help entrepreneurs make informed decisions about their funding options. This article provides an overview of the most common SBA loan programs and their benefits.

One of the most popular SBA loan programs is the 7(a) loan, which can be used for a wide range of business purposes, including working capital, equipment purchases, and real estate acquisition. This flexible loan option allows businesses to borrow up to $5 million, with repayment terms of up to 25 years. Additionally, the SBA 504 loan program is specifically designed for purchasing fixed assets, such as real estate and equipment, making it an excellent choice for businesses looking to invest in their infrastructure.

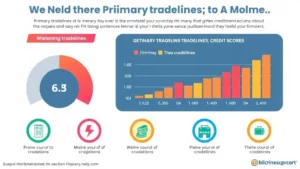

Applying for an SBA loan can be a straightforward process, especially when working with a consulting firm like Primary Tradeline Network. These firms can guide entrepreneurs through the application process, helping them gather the necessary documentation and prepare a strong business plan. By leveraging the benefits of SBA loans, small businesses can access the capital they need to grow and succeed in today's competitive market.