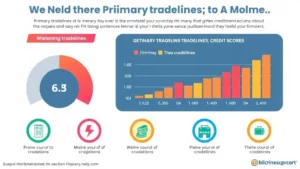

In today's fast-paced business environment, access to immediate funding can be crucial for survival and growth. Emergency credit sweeps are designed to help business owners quickly improve their credit profiles, allowing them to secure necessary financing. This process involves a thorough review and optimization of credit reports, which can lead to increased credit scores in a short period. By understanding how emergency credit sweeps work, business owners can leverage this tool to unlock new funding opportunities.

The first step in an emergency credit sweep is to identify any inaccuracies or outdated information on a business's credit report. These discrepancies can negatively impact credit scores and hinder access to loans and credit lines. By working with a consulting firm like Primary Tradeline Network, businesses can ensure that their credit reports are accurate and reflect their true financial standing. This proactive approach not only improves credit scores but also enhances the overall credibility of the business in the eyes of potential lenders.

Once the credit report has been optimized, businesses can explore various funding options available to them. With a higher credit score, they may qualify for better loan terms, lower interest rates, and increased credit limits. This newfound financial flexibility can empower business owners to invest in growth initiatives, purchase equipment, or even expand their operations. Ultimately, understanding and utilizing emergency credit sweeps can provide a significant advantage in the competitive business landscape.